How to raffle your car?

it is possible to raffle a car in accordance with the regulation of gambling, just as any movable, immovable or movable property or rights linked to them can be the object of a raffle (although it can never consist of monetary prizes), provided that a series of legal requirements are met, which will be described below, in the next point of this article.

Legal requirements to consider: Is it necessary to apply for a license to raffle your car?

With regard to this point, and before describing the legal requirements for organising a raffle, it is important to note that raffles can be of a permanent or occasional nature.

In this regard, it is important to bear in mind that the permanent raffle type of game is not regulated and, therefore, it would not be possible to organise and market such raffles as they are legally considered prohibited in accordance with the provisions of article 5.3 of Law 13/2011, of 27 May, on the Regulation of Gambling.

Consequently, Spanish gambling regulations only allow the organisation of occasional or sporadic raffles, and the holding and organisation of this type of games cannot form part of the usual or ordinary activity or constitute the corporate purpose of an entity.

Notwithstanding the above, and despite the fact that the organisation of raffles of an occasional nature is permitted, as indicated above, it is compulsory to request authorisation from the competent body in this respect (i.e. the Directorate General for the Regulation of Gambling – “DGOJ”) in order to be able to organise them.

Specifically, the following details must be included in the raffle application, as stated on the official website of the DGOJ itself:

- Identification of the interested party and, where applicable, their representative.

- Address for the purpose of notifications in Spain.

- Place, date and signature of the applicant.

- Where applicable, request for authorisation to carry out advertising, promotion or sponsorship activities.

The following documentation must also be provided:

- National Identity Card or Passport of the applicant, in the case of a natural person. In the case of legal persons, deed of incorporation or modification, registered in the Mercantile Register or, in the case of foreign companies, in the equivalent Register of the country where they have their headquarters, together with accreditation of the person and the capacity of the person acting on their behalf in Spain.

- Accreditation of being up to date with tax and Social Security obligations.

- Declaration of responsibility for not being in any of the cases established in article 13.2 of Law 13/2011, of 27 May, on the regulation of gambling, of persons who cannot hold licences or authorisations for gambling activities.

- Proof of having paid the fee established in article 49.2.d) of Law 13/2011. At present, the aforementioned fee amounts to 100 Euros.

- Proof of ownership and availability of the prize or prizes offered, which may consist, depending on the case, of invoices, contracts, deeds or notarial certificates. Under no circumstances may other types of documents such as those indicated above be provided, such as, for example, the provision of a pro forma invoice. Similarly, and in the event that the object of the raffle is a zero kilometre or second-hand car, the vehicle registration certificate of the vehicle in question, complete on all sides, and the Full Report of the General Vehicle Register of the Directorate General of Traffic must be provided.

- Legal basis of the raffle. This document must contain certain information about the raffle, such as the identification of the raffle organiser, the start and end dates of the raffle, description of the prize (characteristics of the car such as model, colour, registration number, in the case of a zero kilometre or second-hand car, the kilometres it has, etc.), place and date of publication of the winner, territory of the raffle, etc.

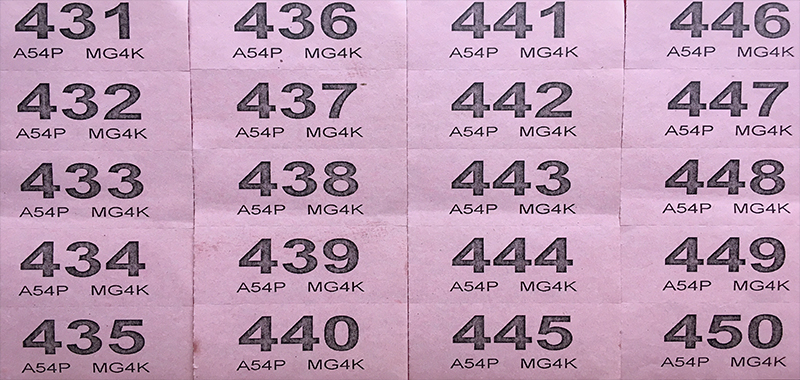

- Participation support form including information on the date of raffle authorisation, total number of supports to be issued and the price per support, prize expiry date, prize value, date and place of the raffle, etc.

Tax regime to be taken into account

Individuals or legal entities that carry out raffles shall be subject to payment of the tax on gambling activities, under the conditions and at the rate established in article 48 of Law 13/2011 (i.e. 20% of the gross income obtained from participation in the game), as well as any other income that may be obtained, directly derived from the organisation or holding of the raffle. Notwithstanding the above, and in the case of raffles declared to be charitable or of public utility, the rate shall be 7%.

The management, collection, settlement and inspection of the tax shall be the responsibility of the State Tax Administration Agency.

Likewise, individuals or legal entities that carry out raffles shall be obliged to make payments to the Treasury, as payment on account of the Personal Income Tax corresponding to the recipient, which are derived from the regulations in force at any given time for this tax, which may be charged to the organiser himself or to the winner at the organiser’s decision. The raffle prizes are not subject to Value Added Tax.

Letslaw es una firma de abogados internacionales especializada en el derecho de los negocios.