How to get the tax residence certificate in Spain?

The tax residence certificate is issued only when the AEAT considers that your tax residence is in Spain. It is possible to distinguish the countries of residence in which there is a double taxation agreement from those that do not.

In the certificates of tax residence in Spain for countries with an agreement, the tax authorities of Spain certify that you are a resident within the meaning of the agreement between Spain and other country.

In the certificates of tax residence in Spain for countries without an agreement, the tax authorities of Spain certify that you are a resident in Spain.

In both cases, the certificate will be issued in Spanish and English.

Where can you get it?

The certificate is obtained electronically on the AEAT website, for which it is necessary to have one of the following electronic means of identification: electronic identification certificate, electronic ID, or Cl@ave PIN. We recommend having the electronic certificate of identification (or Digital Certification).

It can also get it in person at the Tax Agency Delegations and Administrations. However, in this case it would be necessary to make an appointment, either by calling 901 200 351 or 91 290 13 40, or through the following link.

In the event that you want to modify or cancel the appointment, you must access the appointment service again.

When you log in, the appointments already assigned will be shown with the corresponding option to modify or cancel it.

Tax residence certificate request in Spain

You can apply for the certificate by accessing directly through the following link, which will take you to the certificate application page.

Once you click on “Solicitud”, it will ask for your ID, or access with a certification or electronic ID. The usual and simplest way to do this is by means of an electronic certification.

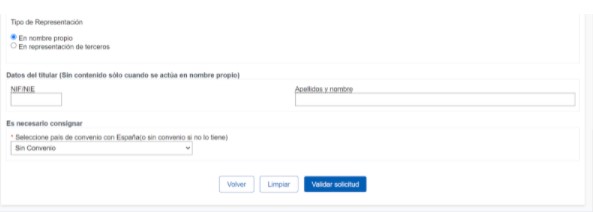

After having accessed, it will ask you if you apply on your own behalf or on behalf of third parties (if you select on behalf of third parties, you will have to fill in the following row of data: “NIF/NIE”, which is your ID, and “Apellidos y nombre”, which is your surname and name). However, not just any natural person, only social partners can request on behalf of third parties.

Finally, you will have to select the country to check wheter or not it has an agreement with Spain. In the event that your country does not appear among the options, it will mean that it does not have an agreement and you will have to select the option “Sin Convenio”. For groups of companies from different Member States, the option “Específico para el artículo 2 de la Directiva 2011/96/UE”.

When you have completed everything, you can validate the request and sign it, thus completing the certificate request.

Issuance of certificates

The competent body of the tax administration usually issues the certificate within 20 days of its request, and it is sent according to the following priority:

- To the address indicated for this purpose in the application (in the case of applications submitted to an Administration of the AEAT).

- To the electronic address of the applicant if he had subscribed to the electronic notification service in the DEH.

- To the address recorded for the purposes of notifications in forms 030, 036 or 037.

- To the fiscal domicile.

In the case of request made over the Internet with an electronic signature or Cl@ve PIN, the certification will be obtained directly at the electronic office.

Effects of tax certificates

Tax certificates are for informational purposes only and no appeal can be filed against them. But you can show your disagreement with any of the data that is part of the content within 10 days, by writing requesting the modification of the certification, addressed to the body that issued it. You must attach the elements of proof that you deem appropriate to prove your request.

Validity of certificates

The tax certificates will be valid for 12 months from the date of issue as long as there are no changes in the circumstances determining their content.

Verification of the authenticity and validity of the certificates

The content, authenticity and validity of the certificate can be checked at the AEAT electronic headquarters at this link. The Secure Verification Code (CSV) that appears on the certificate will be used.

The copies of the certificates will have the same validity and will produce identical effects to the certificates, since the content, authenticity and validity of the copies can be verified by means of the Secure Verification Code.

Letslaw es una firma de abogados internacionales especializada en el derecho de los negocios.